Council Tax, what it pays for, how it is calculated, who pays it, how to appeal your Council Tax banding, previous years’ charges and how to contact the North Lincolnshire Council Tax team.

Council Tax charges

Council Tax is tax charged on households by local authorities, based on the estimated value of a property and the number of people living in it. We also take into account any discounts or exemptions that apply because of the circumstances of the people living in the property, or because of the status of the property. It helps to meet the cost of the services we provide, as well as contributing towards the cost of fire brigade, police, environment and adult services.

Most households have to pay Council Tax. There is one bill per property, whether it is owned or rented.

See who is eligible to pay Council Tax on the Gov.uk website.

Council Tax charges, appeals and liability

Each dwelling falls into one of eight bands according to its open market value on 1 April 1991. These bands are decided by the Valuation Office. The Valuation Office Agency (VOA) maintains the Council Tax Valuation list. This includes placing new properties within a Council Tax Band and changing bands for properties when necessary.

To understand why your property is in a certain band, please see How domestic properties are assess for Council Tax bands. Your Council Tax bill shows which band applies to your property.

Your rate of Council Tax includes:

- The total value of taxable property (the tax base)

- The amount required to fund the service requirements of North Lincolnshire Council, Humberside Police and Humberside Fire Authority

- The amount required to fund town and parish councils . Enquiries about town and parish council precepts should be addressed to the relevant clerk of the council concerned. Visit our town and parish councils webpage for clerks’ contact details.

Parishes setting a precept over £140,000:

The Environment Agency can request money from us for the services they provide in a financial year. This is known as a levy. These are included in your Council Tax charge but are not detailed separately on your Council Tax bill. Details of the Local Levy for 2024/25 is shown on the Environment Agency Leaflet [PDF, 64Kb]

Check your Council Tax band on Gov.uk.

View the list of Council Tax bands in England (based on 1 April 1991 values) on the Gov.uk website.

Read more about changes that may affect your Council Tax band on the Gov.uk website.

Council Tax per parish-2024-25 [PDF, 410Kb]

Bills are normally paid in ten monthly instalments between April and January, but if you would like to spread your payments over the full financial year (up to March) please contact the Council Tax team on counciltax@northlincs.gov.uk or call 0300 3030164 (option 5).

Depending on your payment method, there are up to four payment dates available:

For cash – instalments by the 1st day or the or the 15th day of each month.

For Direct Debit – instalments can be taken from your bank account on the 1st, 8th, 15th or 22nd day of the month.

Please visit our Paying your Council Tax page to see the available payment methods.

New payment arrangements are usually set up to be paid from the 1st of the month. To change your payment date, contact the Council Tax team.

If you wish to pay your bill in full please pay by the first instalment date. If you wish to pay half-yearly please ensure the first payment is made by the first instalment date and the second payment is made on or before 1 September.

Amounts due should be received on or before the instalment dates shown on your bill. Notices will be issued if payment is not received by the due date. If you miss your instalment dates, you may be asked to pay in full.

You can find out how much Council Tax you have left to pay this year by using our Self Service Portal.

Once you are registered and logged in, go to the ‘My Accounts’ section and confirm your Council Tax account details to view your balance.

You will need your Account Reference to use this service.

If you pay by cash and have lost your bill, please call 0300 3030164 (option 5) and request another copy.

You can apply to get money off your Council Tax bill if you are on a low income or claiming benefits. Visit the Council Tax support scheme page for more information.

If you require an explanation of your bill in a different format, please contact us.

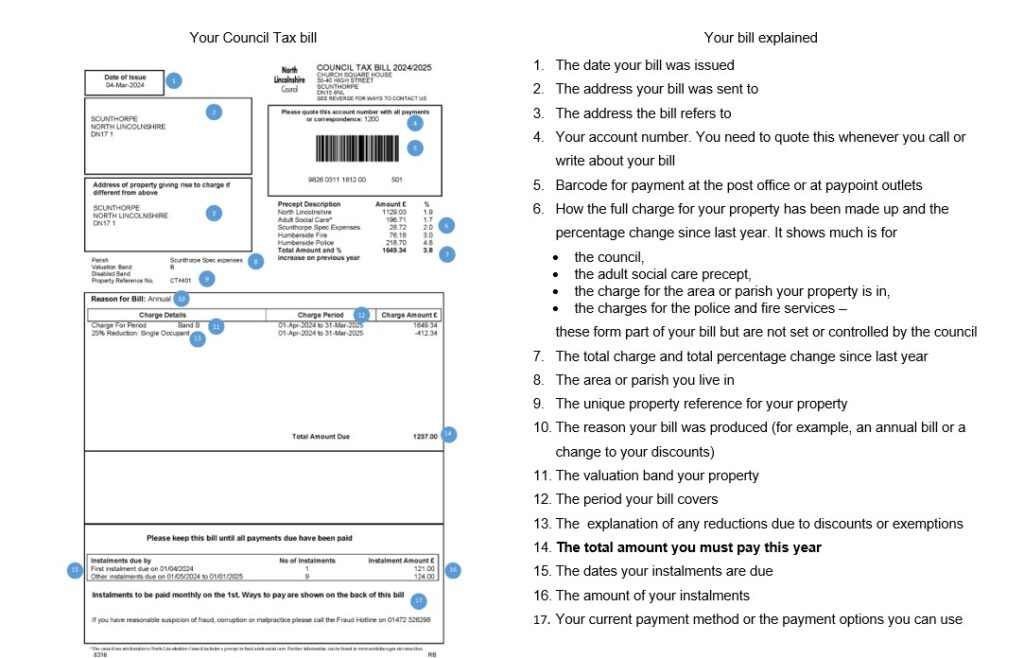

Your bill explained

- The date your bill was issued

- The address your bill was sent to

- The address the bill refers to

- Your account number. You need to quote this whenever you call or write about your bill

- Barcode for payment at the post office or at paypoint outlets

- How the full charge for your property has been made up and the percentage change since last year. It shows much is for

- the council,

- the adult social care precept,

- the charge for the area or parish your property is in,

- the charges for the police and fire services –

these form part of your bill but are not set or controlled by the council

- The total charge and total percentage change since last year

- The area or parish you live in

- The unique property reference for your property

- The reason your bill was produced (for example, an annual bill or a change to your discounts)

- The valuation band your property

- The period your bill covers

- The explanation of any reductions due to discounts or exemptions

- The total amount you must pay this year

- The dates your instalments are due

- The amount of your instalments

- Your current payment method or the payment options you can use.

Your Council Tax bill includes charges from the Police Commissioner, the Fire Authority and Parish and Town Councils, as well as for North Lincolnshire Council. It also includes a precept for Adult Social Care which can only be spent for that purpose. The government statement on the adult social care precept can be read on Legislation.gov.uk. The information below shows the funding raised for each organisation and how much a Band D Council Tax payer will pay.

- North Lincolnshire Council £75.2m

- Band D cost £1451.61

- Adult Social Care Precept £13.1m

- Band D cost £252.91

- Police Precept £14.6m

- Band D cost £281.18

- Fire Precept £5.1m

- Band D cost £97.94

- Parish Precepts £1.9m

We normally charge Council Tax for empty properties. The aim is to bring empty properties back into use.

If your property has been unoccupied for a year or more, you’ll be charged a premium on the amount of Council Tax you would normally pay.

This premium will vary depending on how long the property has been empty.

The charges from 1 April 2024 are

- Empty for 1 year an additional premium equivalent to 100% of the council tax liability

- Empty for 5 years an additional premium equivalent to 200% of the council tax liability

- Empty for 10 years an additional premium equivalent to 300% of the council tax liability.

There are a number of exceptions to the application of an empty property premium:

- a dwelling which would otherwise be the sole or main residence of a member of the armed services, who is absent from the property as a result of such service;

- a dwelling, which forms part of a single property that is being treated by a resident of that property as part of the main dwelling;

- the property is currently marketed for sale or for rent at a level which could reasonably expect to be achieved given the property and location (proof of this will be required).

If your property is empty and undergoing refurbishment this is insufficient cause to have the additional premium removed.

If you believe that an exemption may apply, or if your property is occupied and should not be on our empty property list, please contact us on counciltax@northlincs.gov.uk.

Alternatively, you can access advice and assistance from our Housing team who can help find solutions to bring your empty property back into use by visiting our Empty Homes page.

To appeal or challenge a banding decision you need to go the Valuation Office Agency website

If you consider that you are not liable to pay Council Tax because you are not the resident or owner, because your property is exempt, or if you think that the council has made a mistake in calculating your bill, you should make an appeal in writing to the council as soon as possible. You must continue to pay your bill until your case has been considered. If you do not, you may lose the right to pay by instalments.

- 2023-24 Council Tax per parish [PDF, 222Kb]

- 2022-23 Council Tax per parish [PDF, 19Kb]

- 2021-22 Council Tax per parish [XLS, 20Kb]

- 2020-21 Council Tax band charges [PDF, 19Kb]

- 2019-20 Council Tax band charges [PDF, 241Kb]

Freeman of the land – legality of Council Tax

Council Tax legality and ‘Freeman of the land’

Council Tax is not a direct charge for services provided. It is a Statutory Tax levied on occupiers (and some owners) of dwellings within the Council’s area. Council Tax is not a direct charge for individual services received; the amount collected is paid into a central fund to enable the Council to provide services for the benefit of the community as a whole.

The Freeman on the Land movement and similar groups commonly believe that people are only bound by the contracts and laws they have consented to. However, contract law and alleged rights under common law are not the same as legislation relating to the administration and collection of Council Tax.

You do not have a choice as to whether you are liable for Council Tax and being a ‘freeman’ does not exempt anyone from paying Council Tax.

In the UK, liability for Council Tax is determined by the Local Government Finance Act 1992. This statute, created by a democratically elected Parliament of the United Kingdom which has received the assent of the Crown and subsequent statutory regulations, sets out a local authority’s rights to demand Council Tax to fund services and who is liable to pay.

Your liability for Council Tax is not dependent on, and does not require, your consent or the existence of a contractual relationship with the council. Any assertion to the contrary is incorrect and there is no legal basis upon which to make this argument.

Can I withhold payment of my Council Tax bill?

Anyone who withholds payment will have recovery action taken against them.

In extreme cases this could even lead to committal proceedings, or even a prison sentence, as in the Manchester Magistrates’ court vs McKenzie (2015) case, where an individual who attempted to use similar ‘freeman on the land’ defences in court ended up in prison for 40 days.

If you have any concerns over the charging of Council Tax, please seek proper legal advice, rather than relying on internet sources or forum statements which may be incorrect or misleading.

Council Tax legislation

The legislation that covers Council Tax is freely available from the government website, including:

- Local Government Finance Act 1992

- Council Tax (Administration and Enforcement) Regulations 1992

- Council Tax (Demand Notices) (England) Regulations 2011

Some residents have asked whether Acts and Statutes are an obligation on them, and about the difference between a Statute and Law and other similar questions regarding legal matters. Acts of Parliaments are Statutes which set out the law. If you have questions regarding other Acts of Parliament or laws, these should be directed to a legal professional, not the council.

Very occasionally we get people who are convinced that using an archaic law means they don’t have to pay Council Tax and there are many misleading articles and templates on the internet regarding the legality of Council Tax. Anyone drawing on these for advice should exercise caution and seek proper legal advice before using them as a defence against Council Tax liability based on contract, consent and common law.

Whilst we do our best to answer all relevant enquiries about Council Tax, we reserve the right to refuse to respond to lengthy spurious enquiries that focus on hypothetical arguments that have no basis in statute which use our resources at the expense of other taxpayers.

Contacting the Council Tax team

You can contact us Monday to Friday, 9am to 4.30pm.

counciltax@northlincs.gov.uk

0300 3030164

If you need to write to us:

Council Tax

North Lincolnshire Council

Church Square House

30-40 High Street

Scunthorpe

DN15 6NL